Renting a home comes with fewer responsibilities than owning one, but that does not mean you are off the hook when things go wrong. Damage inside a rental unit can still cost you money, especially if it affects your deposit or leads to repair bills. The good news is that most damage is preventable. You just need to know what to watch for and how to act early.

Understand What You’re Responsible For

Before anything else, carefully read your lease. Many renters assume the landlord handles all repairs, but leases often include clauses that shift responsibility. You might be on the hook for clogged drains, broken fixtures, or pest control if the damage is linked to how you live.

Look for these key phrases:

- “Tenant shall maintain…”

- “Tenant responsible for…”

- “Damage caused by negligence…”

If your lease includes these, you need to be proactive. Waiting until something breaks may cost you more than fixing it early.

Water Damage: The Silent Wallet Killer

Leaks are sneaky. A dripping faucet or slow toilet leak may seem minor, but over time, they can cause mold, rot, and inflated water bills. Worse, if the leak spreads to another unit, you could be liable for their damage too.

Here’s what to do:

- Check under sinks monthly for moisture or soft wood

- Report any ceiling stains or wall bubbles immediately

- Avoid flushing wipes or pouring grease down drains

- Use a shower curtain liner to prevent water from escaping

If you spot a leak, document it. Take photos and email your landlord. That creates a paper trail in case repairs are delayed.

Appliance Use: Small Habits, Big Impact

Most damage from appliances comes from misuse. Overloading the washer, slamming fridge doors, or ignoring strange noises can shorten their life—and leave you paying for replacements.

Smart habits include:

- Cleaning lint traps after every dryer use

- Running dishwashers only when full

- Avoiding heavy pots on glass stovetops

- Keeping fridge coils clean if accessible

If an appliance breaks and the landlord believes you caused it, you may lose part of your deposit or face repair fees. Treat appliances like borrowed tools, not personal property.

Walls and Floors: Easy to Damage, Hard to Fix

Scuffed floors, chipped paint, and nail holes may seem harmless, but they often lead to deductions when you move out. Some landlords charge per mark, not per room.

To avoid this:

- Use removable hooks instead of nails

- Place rugs in high-traffic areas

- Avoid dragging furniture across floors

- Patch small holes before move-out

If you want to hang art or shelves, ask for permission. Some leases allow it with approval, which protects you later.

Pests: Prevention Beats Cleanup

Roaches, ants, and rodents are more than a nuisance. They can damage wiring, contaminate food, and trigger lease violations. Most infestations start with crumbs, clutter, or poor sealing.

Keep pests out by:

- Sealing food in containers

- Taking out trash regularly

- Cleaning spills immediately

- Reporting gaps or holes near windows and pipes

If you see signs of pests, act fast. Waiting allows them to spread, and some landlords may argue the infestation is your fault.

Insurance: Your Safety Net

Renters insurance is often overlooked, but it matters. It covers your belongings if there’s a fire, theft, or water damage. Some policies also include liability coverage, which protects you if someone gets hurt in your unit or if you accidentally damage another tenant’s property.

Basic policies cost around $15–$25 per month. That is cheaper than replacing a laptop, couch, or wardrobe after a flood.

Document Everything

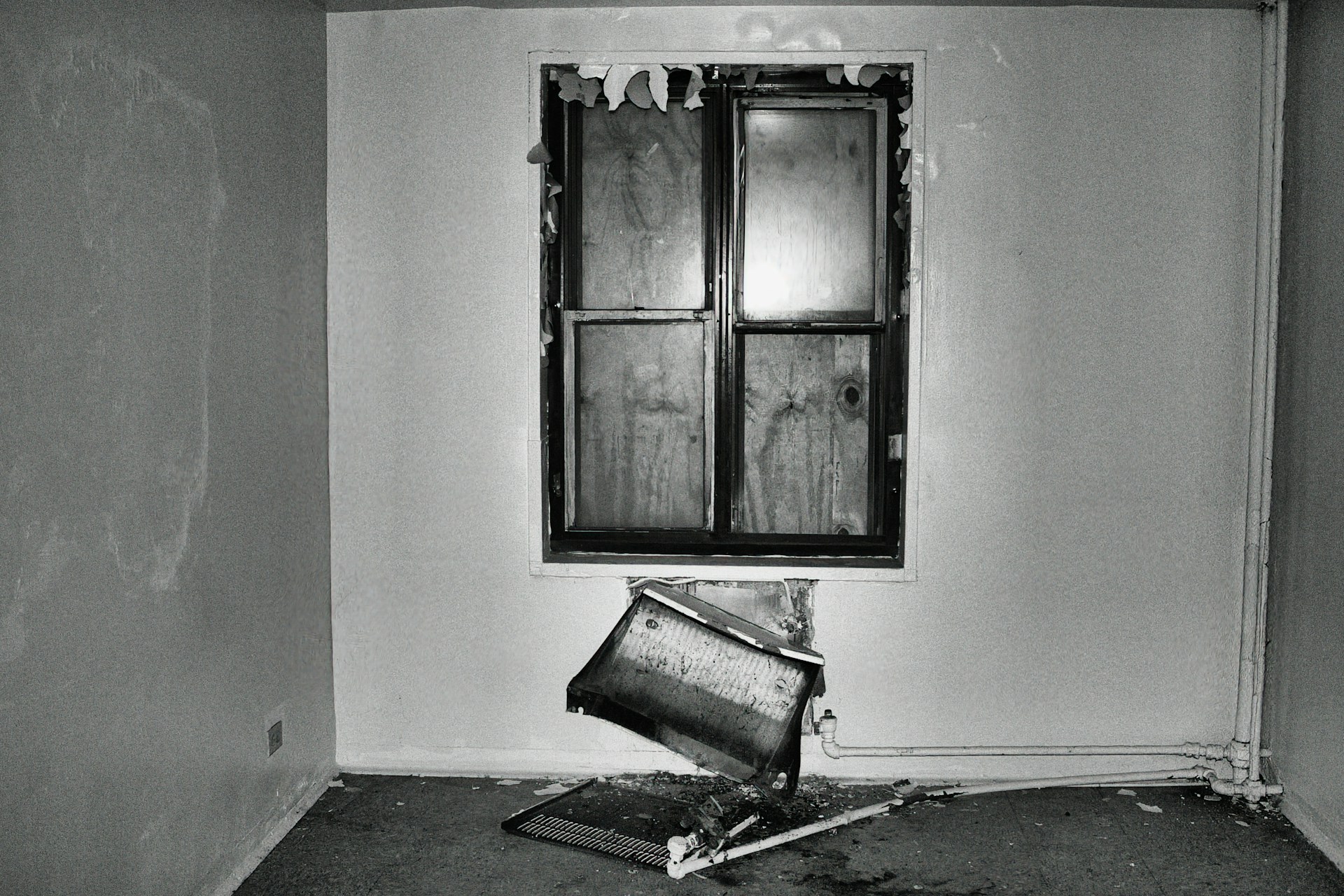

Photos are your best defense. Before moving in, take pictures of every room—walls, floors, appliances, windows. Save them in a folder with timestamps. If something breaks later, you can prove it was already damaged.

During your lease, keep records of maintenance requests, emails, and repairs. If there’s a dispute, you will have proof.

Prevention Is Cheaper Than Repair

Most costly damage starts small. A loose tile, a slow leak, a forgotten spill. Catching these early saves money and stress. Landlords want tenants who care for the property. When you show that effort, you build trust—and protect your wallet.

Renting does not mean ignoring problems. It means managing them smartly. With the right habits and a little attention, you can avoid damage, keep your deposit, and live comfortably without surprise costs.

Leave a Reply